Key Points

- A home warranty covers repairs or replacements for major home systems and appliances that break down over time.

- It offers peace of mind and predictable costs compared to paying for unexpected repairs out of pocket.

- Plans vary by provider, coverage level, and optional add-ons like pool or roof protection.

- Regular maintenance helps reduce future repair claims and overall costs.

- Annual home warranty prices typically range between $600 and $8,100.

What Should You Know About Home Warranty?

A home warranty is a service contract that covers the repair or replacement of important home systems and appliances that break down over time. Unlike home insurance, which covers damage from unexpected events like fires, floods, or theft, a home warranty specifically covers wear and tear issues.

What is a Home Warranty?

A home warranty is a service contract that covers the repair or replacement of important home systems and appliances that break down over time. Unlike home insurance, which covers damage from unexpected events like fires, floods, or theft, a home warranty specifically covers wear and tear issues.

How Does a Home Warranty Work?

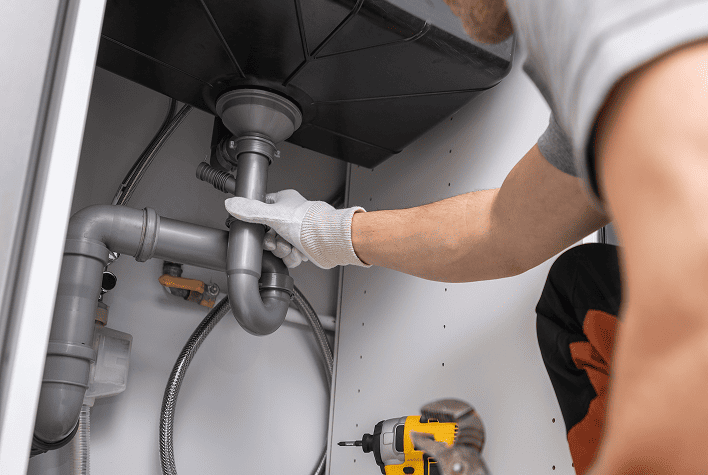

When a covered item breaks down, you contact your home warranty provider. They will appoint a technician to see what’s wrong. If the problem is covered under your warranty, the provider will cover the cost of the repair or replacement, minus any service fee you need to pay. This fee is usually a small, fixed amount and is specified in your contract.

Let’s see how it works:

How is a Home Warranty Different from Home Insurance?

While both protect homeowners, home warranties and home insurance serve different purposes:

TABLE

Pros and Cons of a Home Warranty

TABS

What Is Typically Covered and Not Covered by a Home Warranty?

While home warranty plans can vary, most include similar coverage for home systems and appliances. Here’s a detailed look at what you can generally expect.

What Is Typically Covered

Home warranties usually cover major home systems and appliances. Here are the common categories:

Home Systems:

Home Appliances:

What Is Not Typically Covered

While home warranties cover many essential systems and appliances, they do not cover everything. Here are the items and issues generally not covered:

Factors That Affect Home Warranty Pricing

The cost of a home warranty can vary widely based on several factors. Let’s look at them closer.

Provider and Selected Plan

Different home warranty companies offer various pricing structures. Basic plans cover essential systems and appliances, while more comprehensive plans include additional items. Comparing providers can help you find the best price for the coverage you need.

- Budget-friendly$600 - $900 per year

- Mid-range$900 - $1,500 per year

- Premium service$1,500 - $8,100 per year

Add-On Coverage

If you opt for add-on coverage for items like pools, spas, septic systems, or second refrigerators, the cost will increase. Each add-on comes with an additional fee and costs $40 – $180 per year. Common add-ons include pool/spa, septic system, well pump, or roof leak coverage.

Payment Frequency

- Monthly paymentsMay increase total cost by 5-10%

- Annual paymentOften comes with a discount

Service Call Fee

You pay this fee every time you call for a technician. A lower service call fee usually means a higher annual premium, while a higher service call fee can lower your annual cost.

- Lower service fee ($60-$75)Increases annual premium

- Standard service fee ($75-$100)Normal pricing

- Higher service fee ($100-$125)May lower annual premium

Home Size

Larger homes may require more extensive coverage, thus increasing the price.

- Under 1,000 sq ftMay qualify for discounts

- 1,000 - 2,500 sq ftStandard pricing

- 2,500 - 5,000 sq ftMay increase cost by 10-30%

- Over 5,000 sq ftMay require custom pricing

Location

The average cost of a home warranty varies depending on where you live. Some regions have higher labor and parts costs, which can raise the price of coverage.

- Rural areasMight increase cost due to service availability

- Urban areasGenerally standard pricing

- States with high cost of living (e.g., California, New York)May increase cost by 10-20%

Home Age

Older homes with aging systems and appliances may cost more to cover due to the higher likelihood of breakdowns.

- New to 10 years oldMay qualify for discounts

- 10-20 years oldStandard pricing

- 20+ years oldMay increase cost by 10-25%

Customization Options

- Ability to remove items you don't needCan lower cost by 5-15%

- Increasing coverage limitsMay increase cost by 10-30%

Promotions and Discounts

Many home warranty companies offer promotions or discounts for first-time customers, multi-year plans, or bundling with other services.

- New customer discountsCan save 10-20%

- Multi-year contractsMay offer 5-15% savings

- Bundle discounts (e.g., with home insurance)Can save 5-10%

Things to Consider Before Getting a Warranty for Your Home

Before you jump on the first home warranty plan you find, here are some key points to consider:

Tips to Choose a Home Warranty Company for Your Needs

When looking for a home warranty, it’s important to choose wisely. Here are some tips to help you:

HomeBuddy.com stands out as an portal connecting homeowners with reliable, licensed contractors for hassle-free home improvement projects. With thousands of completed projects nationwide, HomeBuddy bridges the gap between homeowners and skilled professionals. Get free, no-obligation estimates and discover top-rated contractors near you!

How to Reduce a Home Protection Plan Cost

Even if you’ve decided a home warranty is a good fit, there are still ways to save money when choosing a plan:

Conclusion

A home warranty can be a great solution to manage the repair cost in your home. While a warranty can provide peace of mind and potentially save money on repairs, it’s crucial to think about your needs and budget.

Always compare several options, analyze your potential maintenance costs, and strive to get the best plan for your needs. At the same time, regular maintenance and careful budgeting can also play a big role in keeping your home running smoothly and avoiding unexpected expenses.

Frequently Asked Questions

Should I have a home warranty?

A home warranty can be a good option if you want peace of mind about unexpected appliance and system repairs. It can help you budget for these costs and avoid the sting of a large repair bill. However, it’s not for everyone. Consider your budget, the age of your home’s systems, and your comfort level with repairs before deciding.

How do home warranty and home insurance differ?

Home warranty covers breakdowns due to wear and tear on your appliances and systems. Home insurance protects your home itself from covered events like fire, theft, or weather damage. They work together to offer complete protection for your home.

What is the term of a home warranty agreement?

Home warranty agreements are typically for one year. You’ll renew the plan annually if you want to continue coverage.

Are home warranty plans a good choice?

Home warranty plans can be a good choice, but it depends on your needs. If you have older appliances or systems that are likely to need repairs, a warranty can provide valuable protection. However, if your home’s systems are newer or you’re handy and comfortable fixing minor issues yourself, you might save money by skipping the warranty.